The maxim “knowledge is power” applies to just about every facet of everyday life, but even more so when it comes to investing in the financial markets. In today’s online, computer-driven investing world, knowing the right information is often the difference between being an investor in the driver’s seat of your investments and a helpless passenger. While there are different ways to assess the value and growth potential of a stock, fundamental analysis remains one of the best ways to help you establish a benchmark of a stock’s performance in the market. This results in informed investing decisions.

Understanding Fundamental Analysis

Fundamental analysis involves critically examining a business at its most basic or fundamental financial level. The goal here is to assess the business model, financial statements, profit margin, and other key indicators to determine the financial situation of a business and the intrinsic value of its stock. By arriving at a forecast of future stock price movements, informed investors can profit from them accordingly. Fundamental analysts believe that the price of a stock alone is not enough to accurately reflect all available information. That’s why they typically study economic, industry, and company analysis to derive the current fair value and forecast the future value of a stock.

If the fair value and current stock price are not at par, the expectation is that the market price will ultimately gravitate toward fair value. They then capitalize on these perceived price discrepancies and profit from the price movements. For instance, if the stock’s current market price is higher than the fair value, then it is considered overvalued which results in a sell recommendation. However, if the stock’s current market price is lower than the fair value, then is deemed to be undervalued. This means that the price is expected to go up eventually, so it is a good idea to buy it now.

Top Fundamental Analysis Indicators

There are so many fundamental analysis parameters that can be used to ascertain the financial health of a company. The most popular ones are geared toward growth, earnings, and market value. Understanding these key indicators can help you make more informed buy or sell decisions.

1. Earnings per Share (EPS)

This is the portion of a company’s profit that is assigned to each share of its stock. It’s essentially the bottom line net income, just on a per-share basis. A growing EPS is a good sign to investors because it means that their shares are likely to be worth more.

You can calculate the earnings per share of a company by dividing its total profit by the number of outstanding shares. For example – If the company reports a profit of $350 million and there are 100 million shares, then the EPS is $3.50.

2. Price to Earnings Ratio (P/E)

The price-to-earnings ratio measures the relationship between the stock price of a company and its per-share earnings. It helps investors determine if a stock is undervalued or overvalued relative to others in the same sector. Since the P/E ratio shows what the market is willing to pay today for a stock based on its past or future earnings, investors simply compare the P/E ratio of a stock to those of its competitors and industry standards. A lower P/E ratio means the current stock price is low relative to earnings, which is favorable to investors.

The Price to Earnings Ratio is calculated by dividing the current price per share of a stock by the company’s earnings per share. For example – If a company’s stock currently sells for $70 per share with earnings per share of $5. The P/E ratio amounts to 14 ($70 divided by $5).

There are two main types of PE ratios; forward-looking and trailing PE ratio. The difference between the two has to do with what types of earnings are used in the calculation. If the one year projected (future) earnings are used as the denominator in the calculation, then the result is a forward-looking PE ratio. Whereas, if the historical trailing 12-month earnings are used, then you’ll get the trailing PE ratio as the result.

3. Projected Earnings Growth (PEG)

The P/E ratio is a good fundamental analysis indicator but is somewhat limited by the fact that it doesn’t include future earnings growth. The PEG compensates for this by anticipating the one-year earnings growth rate of the stock. Analysts can estimate the future growth rate of a company by looking at its historical growth rate. This provides a more complete picture of a stock’s valuation. To calculate Projected Earnings Growth, divide the P/E ratio by the company’s 12-month growth rate. The percentage of the growth rate is removed from the calculation.

For example, if the growth rate is 10% and the PE ratio is 15, then the PEG formula looks like this:

- PEG = PE Ratio / Earnings Growth

- PEG = 15 / 10 -> notice how the 10% turns into just 10

- PEG = 1.5

The general rule of thumb is that when a stock’s PEG is above 1 it is considered overvalued. Whereas, if it’s below 1, it is considered undervalued.

4. Free Cash Flow (FCF)

In simplest terms, Free Cash Flow is the cash left over after a company has paid for its operating expenses and capital expenditures. Cash is critical to the sustenance and amelioration of a business. Companies with high free cash flow can improve shareholder value, fund innovation, and survive downturns better than their less-liquid counterparts. Many investors cherish FCF as a fundamental indicator because it shows whether a company still has enough cash to reward its shareholders through dividends after funding operations and capital expenditures.

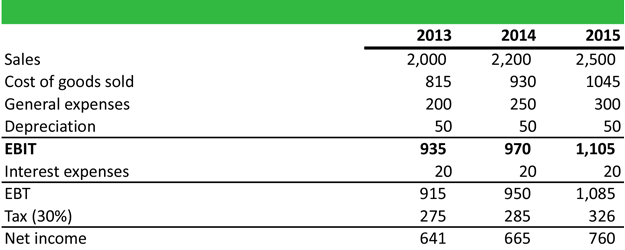

FCF is calculated as Operating Cash Flow minus Capital Expenditures (CAPEX) as recorded on the cash flow statement. It can also be deduced from the Income statement as Net Operating Profit After Taxes (NOPAT) plus depreciation, minus working capital and capital expenditure (CAPEX). Examine the statement and formulas below. We’ll calculate the 2015 FCF:

- NOPAT = EBIT – Tax

- NOPAT = 1,105 – 332 = 774

- FCF = NOPAT + Depreciation – (Working capital and CAPEX)

- FCF = 774 + 50 – (120 + 30) = 674

5. Price to Book Ratio (P/B)

Also known as the price-to-equity ratio, the price-to-book ratio is a fundamental analysis indicator that compares the book value of a stock to its market value. By showing the difference between the stock’s market value and the value the company has stated in its financial books, P/B helps investors determine whether the stock is under or overvalued relative to its book value. It is calculated by dividing the stock’s most recent closing price by the book value per share as listed in the company’s annual report. Book value is calculated as the cost of all assets minus liabilities. It is the theoretical value of a company if it will be liquidated.

However, the price-to-book ratio of a particular company is not useful just by itself. An investor needs to compare a company’s P/B ratio to others within the same sector or industry. Only then will it be useful in determining which company may be undervalued or overvalued relative to others.

6. Return on Equity (ROE)

ROE is a profitability ratio that signifies the rate of return a shareholder receives for the portion of their investment in that company. It measures how well a company generates positive returns for its shareholders’ investments. Since profit is an actual driver of stock prices, separating out the profits earned with shareholder equity is actually a pretty good indicator of the financial health of a company and the fair value of its stock. You can calculate Return on Equity by dividing net income by average shareholders’ equity.

The DuPont analysis further expands on the calculation by adding several variables to help investors better understand the company’s profitability. This analysis looks at these main components:

- ROE = Net Income / Equity, which can be further broken down into:

- Profit Margin = Net Income/Revenue

- Turnover Ratio = Revenue/Assets

- Leverage = Assets/Equity

The expanded ROE formula when doing the DuPont analysis looks like this:

- ROE = Profit Margin x Turnover Ratio x Leverage

- ROE = Net Income/Revenue x Revenue/Assets x Assets/Equity

- ROE = ROA x Assets/Equity

Using the DuPont analysis an investor is able to determine what’s driving the ROE. Is it a high-profit margin and/or very quick turnover ratio and/or high leverage?

Another important part of understanding the ROE is that it’s ultimately the return on assets (ROA) multiplied by the leverage. ROA is a financial ratio that measures a company’s profitability by calculating the amount of profit (net income) the company generates in relation to the number of assets it has. It is expressed as a percentage and can be calculated by taking the company’s net income and dividing it by the company’s total assets. A higher ROA percentage indicates that a company is using its assets more efficiently to generate profit.

Here are the formulas that tie this in with the DuPont analysis:

- ROA = Profit Margin x Turnover Ratio

- ROA = Net Income/Assets

This translates to:

- ROE = ROA x Leverage

- ROE = ROA x Assets/Equity

7. Dividend Payout Ratio (DPR)

As you know, companies pay a part of their profits to their shareholders in the form of dividends. But it’s also important to know how well the company’s earnings support those dividend payments. This is what the Dividend Payout Ratio is all about. It tells you what portion of net income a company returns to its shareholders, as well as how much it sets aside for growth, cash reserve, and debt repayments. DPR is calculated by dividing the total dividend amount by the company’s net income in the same period. It’s usually calculated as an annual percentage.

8. Price to Sales Ratio (P/S)

The price-to-sales ratio is a fundamental analysis indicator that can help determine the fair value of a stock by utilizing a company’s market capitalization and revenue. It shows how much the market values the company’s sales, which can be effective in valuing growth stocks that have yet to turn a profit or aren’t performing as expected due to a temporary setback. The P/S formula is calculated by dividing sales per share by the market value per share. A lower P/S ratio is seen as a good sign by investors. This is another metric that’s also useful when comparing companies in the same sector or industry.

9. Dividend Yield Ratio

The dividend yield ratio looks at the amount paid by a company in dividends every year relative to its share price. It is an estimate of the dividend-only return of a stock investment. Assuming there are no changes to the dividend, the yield features an inverse relationship with the stock price — the yield rises when the stock price falls and vice versa. This is important to investors because it tells them how much they are getting back from every dollar they’ve invested in the company’s stock.

The dividend yield ratio is expressed in percentage and is calculated by dividing the annual dividend per share by the current share price.

For example, 2 companies (X and Z) pay an annual dividend of $3 per share. Company X’s stock trades at $60 per share, while Company Z’s stock trades at $30 per share. This means Company X’s dividend yield is 5% (3/60 x 100) and Company Z’s dividend yield is 10% (3/30 x 100). As an investor, you would likely prefer Company Z’s stock over Company X’s all else being equal, since it has a higher dividend yield.

10. Debt-to-Equity Ratio (D/E)

The debt-to-equity ratio is the last fundamental analysis indicator on this list. It measures the relationship between a company’s borrowed capital and the capital provided by its shareholders. Investors can use it to determine how a company finances its assets. The debt-to-equity ratio (D/E) helps investors evaluate the financial leverage of a company, signalling just how much shareholder’s equity can fulfil obligations to creditors should the business encounter financial hardship.

You can calculate the ratio by dividing the total liabilities by the total shareholder equity. Check out the consolidated balance sheet below. It shows that Apple Inc. recorded a total of $241 billion in liabilities (highlighted in red) and total shareholders’ equity of $134 billion (highlighted in green).

Based on these figures, debt-to-equity ratio = $241,000,000 ÷ $134,000,000 = 1.80

Conclusion

All the fundamental analysis indicators discussed above are significant in their own right. While they can help you determine the value and growth potential of a stock, it is important to understand that there are several other factors that affect stock prices, most of which are not so easy to measure. That’s why when it comes to evaluating a company’s stock for investment purposes, fundamental analysis is best used in tandem with other tools, such as technical analysis, macroeconomic news, and industry-specific data. This helps you develop a clearer picture of what you want in a stock while using the indicators as benchmarks to measure the worth of potential investments.